Make a profit and manage your energy portfolio with a Powerland BESS!

Your buffer for renewable energy and smart energy trading

Auto consumption & capacity tariff

Continuity in case of grid failure

Day Ahead Market Arbitrage

Imbalance Market Arbitrage

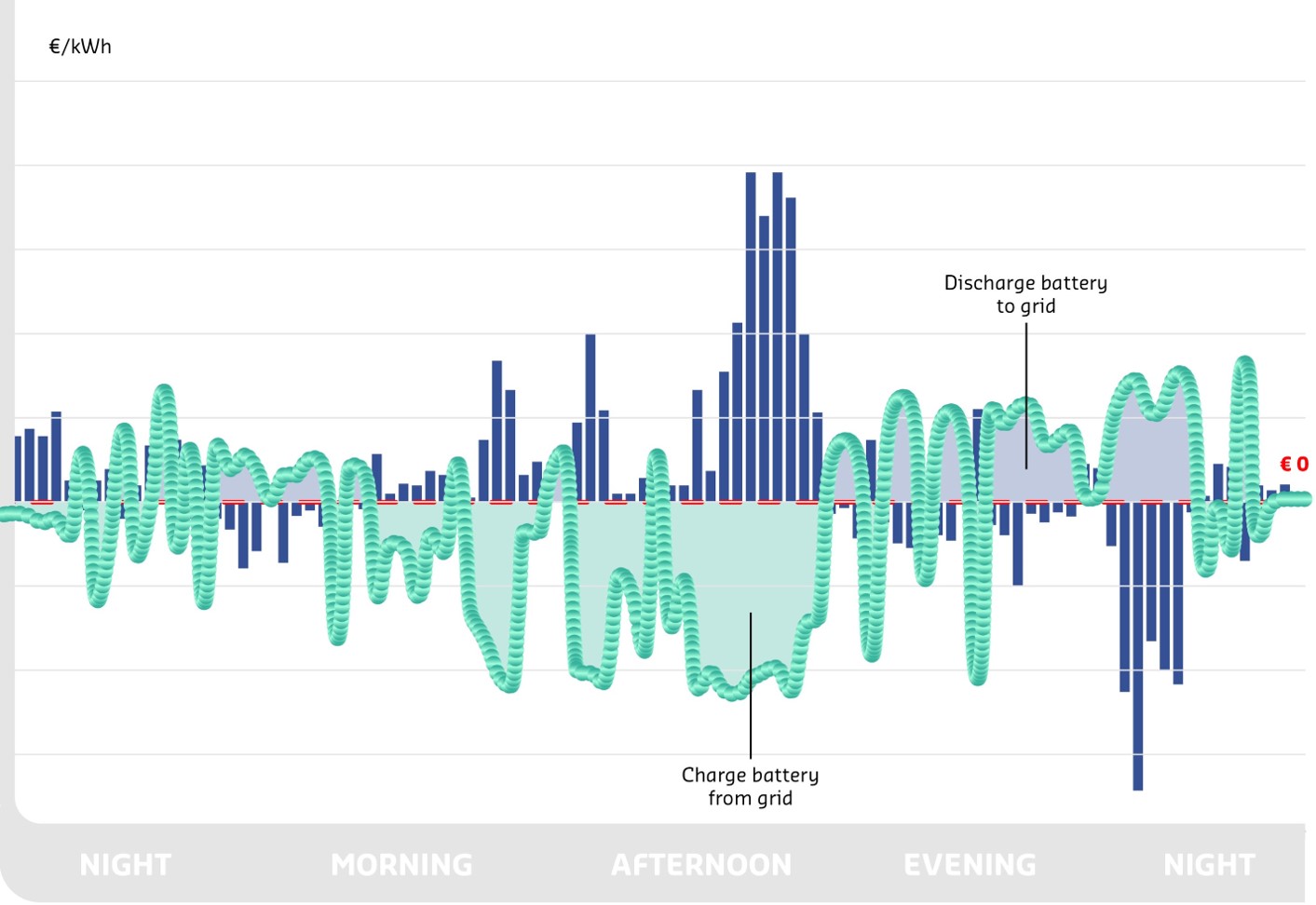

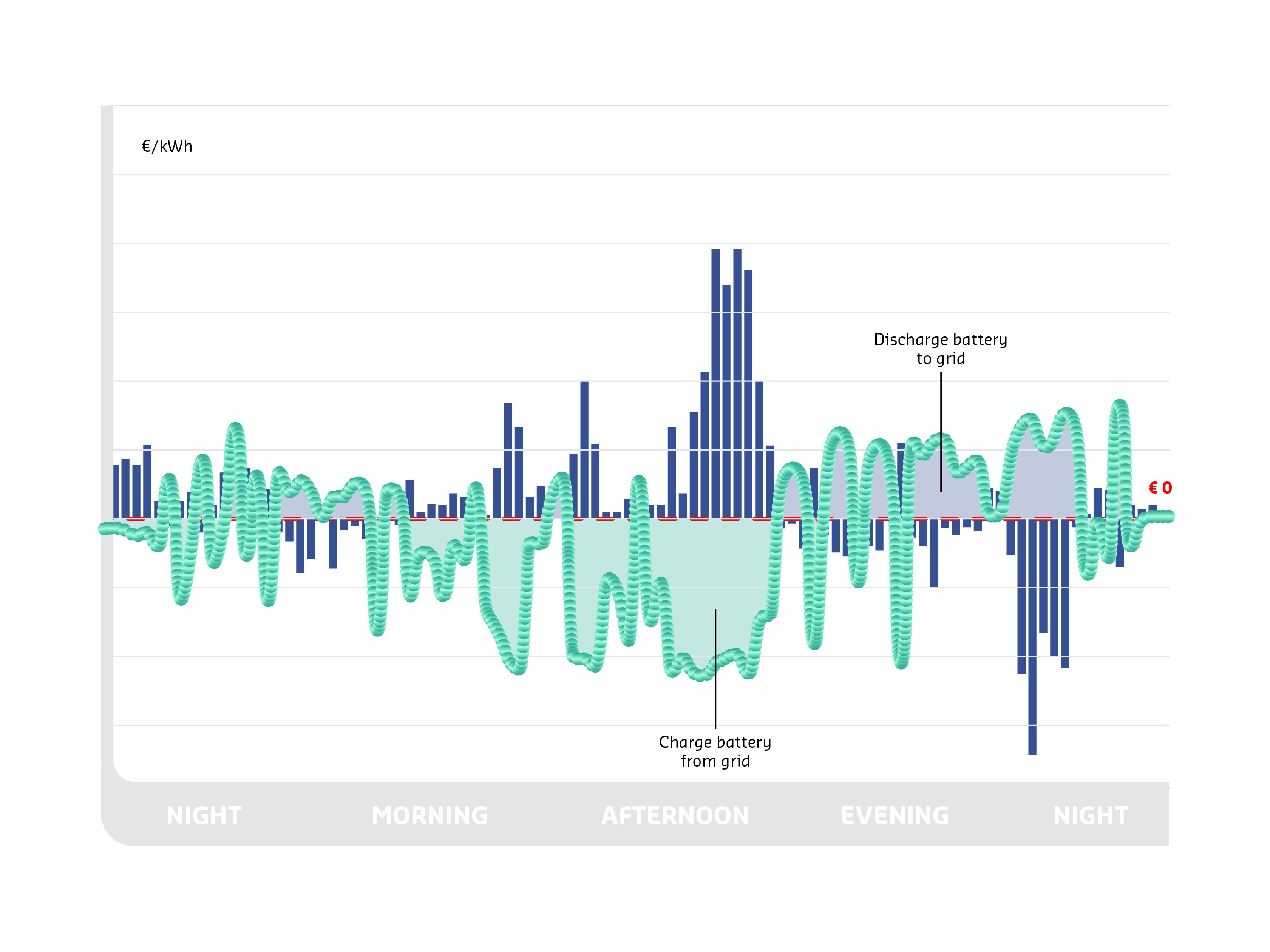

Imbalance Market Arbitrage exploits volatility in the imbalance market to fill deficits and withdraw surpluses. This is done through trading with energy suppliers, where batteries respond flexibly to ad-hoc situations to keep the grid in balance.

BRPs, such as BEE, Yuso, Scholt, Centrica,… play a crucial role in this process by making daily forecasts and taking real-time actions. The day before, BRPs must indicate their expected injections and offtakes, as well as their commercial trading on the electricity market, such as purchases, sales and exchanges with other BRPs.

On the day itself, the BRP maintains the balance within the forecasts by trading on the imbalance market, whereby any shortages are supplemented by purchasing energy from, for example, a BESS, or by importing energy. BRPs also manage imbalances within their own portfolio. All this contributes to an efficient and stable electricity grid.

To maintain real-time equilibrium, BRPs must use all reasonable resources and exchange energy with other BRPs on a day-ahead or intraday basis. However, if a BRP shows an imbalance, ex-post measurement data is used to calculate imbalance rates. This encourages BRPs to keep their portfolio in balance. Through these strategies, battery solutions can create additional value in the imbalance market while providing stability to the electricity grid. In the event of fluctuations in supply and demand, the grid frequency must remain at 50Hz, which is guaranteed by cooperation between grid operator (Elia) and BSPs (Balance Service Providers).